When you're a high earner, the risks of smart financial administration are even higher. Making a lot more doesn't just imply larger incomes-- it likewise indicates larger tax bills. Yet many effective people, in spite of having access to a variety of sources, forget crucial tax planning strategies that can conserve them considerable amounts yearly. In this article, we'll check out the common dead spots high-income earners encounter and why taking an aggressive method to tax obligation planning makes all the distinction.

The Hidden Cost of Delayed Planning

Numerous high-earners fall into the catch of treating tax obligation planning as a year-end task. Scrambling to locate deductions in December hardly ever delivers the financial savings that thoughtful, year-round planning can attain. True optimization takes place when techniques are woven right into every financial choice throughout the year, not just during tax obligation season.

Delaying preparation means losing out on opportunities like making best use of retirement payments at the right times, tactically timing philanthropic donations, or handling financial investment gains and losses efficiently. An experienced financial consultant frequently stresses that tax planning need to be an ongoing conversation, not a hurried job squeezed in before filing due dates.

Overlooking the Power of Tax-Advantaged Accounts

It's unusual just how frequently high income earners overlook the full power of tax-advantaged accounts past the conventional 401(k). Health And Wellness Savings Accounts (HSAs), as an example, deal triple tax benefits-- contributions are tax-deductible, development is tax-free, and withdrawals for qualified expenses are likewise tax-free. HSAs are not just for clinical costs; they can act as a stealth pension when made use of strategically.

Similarly, backdoor Roth IRAs are underutilized tools for high-income earners who phase out of conventional Roth contributions. With cautious sychronisation, this method enables considerable long-lasting, tax-free growth. Leveraging these tools requires foresight and a clear understanding of IRS regulations, yet the payoff can be remarkable over time.

The Importance of Managing Investment Income

High-earners often generate significant financial investment earnings, but not all investment revenue is strained just as. Qualified dividends and lasting funding gains delight in lower tax obligation rates, while interest revenue and short-term gains can trigger a lot higher tax obligations. Without a plan in place, people can unintentionally press themselves into greater tax braces or activate unpleasant shocks like the Net Investment Income Tax (NIIT).

Tax-loss harvesting, asset place techniques, and critical rebalancing are methods that can minimize these problems. Working with seasoned financial advisors in Tampa frequently aids discover these nuanced strategies that can dramatically affect a high income earner's overall tax obligation liability.

Missing Out On the Charitable Giving Advantages

Philanthropic giving is usually seen via a purely selfless lens, yet it's also an effective tax obligation planning tool when done attentively. As opposed to simply composing checks, high-earners can make use of strategies like contributing valued securities or setting up donor-advised funds (DAFs). These techniques not just amplify the charitable effect however additionally give enhanced tax benefits.

Donating appreciated possessions, as an example, permits the benefactor to avoid paying capital gains taxes while still claiming a philanthropic reduction. It's a win-win, yet several wealthy people leave these advantages untapped as a result of absence of recognition or poor timing.

Overlooking State and Local Tax Optimization

It's not simply government tax obligations that need interest. High-earners typically deal with considerable state and local tax (SALT) liabilities, specifically in high-tax states. The SALT reduction cap has actually made this a much more pressing concern, restricting the deductibility of state and regional taxes on government returns.

Moving methods, purchasing municipal bonds, and developing residency in tax-friendly states are advanced steps that may be source appropriate depending on specific scenarios. However, browsing these choices demands knowledge and accuracy-- something Tampa financial advisors typically help their customers achieve with customized guidance.

Estate Planning: The Silent Tax Saver

While estate preparation is often associated with wide range transfer after death, its tax benefits throughout life are typically neglected. Yearly gifting, leveraging lifetime exceptions, and setting up unalterable counts on are all approaches that can minimize both estate and income taxes.

A durable estate plan not only ensures that possessions are handed down efficiently however can also cause substantial tax cost savings today. Waiting till later in life to think about estate preparation misses the possibility to apply strategies that need time to grow and supply maximum benefits.

Why Proactive Advice Matters

At the end of the day, the typical string amongst these missed out on opportunities is the absence of positive, all natural advice. Tax planning is not practically submitting kinds appropriately-- it's about crafting a strategic plan that aligns with personal goals, company rate of interests, and progressing guidelines.

It's very easy to think that due to the fact that tax obligations are unpreventable, the quantity owed is additionally inescapable. Yet with appropriate foresight, wise decision-making, and expert collaboration, high earners can significantly shift their tax obligation end results in their support.

Remain tuned for more understandings and updates by following our blog site. We're dedicated to helping you browse intricate monetary landscapes with clarity and self-confidence. See to it to find back typically for new approaches that can aid you develop, protect, and maintain your riches more effectively!

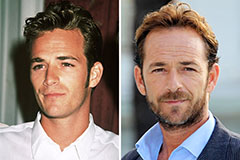

Luke Perry Then & Now!

Luke Perry Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!